multistate tax commission pl 86-272

4 2021 the Multistate Tax Commission MTC made significant revisions to its official guidance on Public Law 86-272 which discusses protected and unprotected. Arizona has promulgated its own ruling on Public Law 86-272.

E Commerce Transactions May Be At Risk For Increased Income Tax Dmj Co Pllc

It is based on the Multistate Tax Commission guidelines with several notable changes.

. Simply put PL 86-272 prevents states from imposing an income tax on a business when its only connection with the state is the. The Multistate Tax Commission MTC adopted its long-awaited guidance interpreting Public Law PL 86-272 protections for internet businesses on August 4 2021. In 1986 the MTC adopted the Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States Under Public Law 86-272 which sets forth.

For the most part the TAM incorporates all the Multistate Tax Commission MTC positions adopted in its Aug. In August 2021 the Commission adopted revisions to its Statement Concerning Practices of the Multistate Tax Commission and Signatory States Under Public Law 86-272 These revisions. The Multistate Tax Commission MTC recently updated its interpretation of long-established Public Law 86-272 PL.

In 2021 the Multistate Tax Commission MTC adopted revised guidance to its interpretation of the application of Public Law PL 86-272 in the context of the online and. Consignment sales under certain. MTC adopts new PL.

In August 2021 the Multistate Tax Commission MTC re-interpreted Federal Public Law 86-272 and in doing so effectively removed several significant out-of-state retailer. On August 4 2021 the Multistate Tax Commission MTC approved an update to its Statement of Information Concerning Practices of the Multistate Tax Commission and. The Multistate Tax Commission MTC has reconsidered its interpretation of Public Law PL 86-272the federal statute that prevents a state from levying a net income.

86-272 1 to address how we transact business through. For over 60 years PL 86-272 has been widely accepted and used by taxpayers to provide immunity from state income taxes when their connections within a state are minimal. What you need to know.

The Interstate Income Act of 1959 commonly known as Public Law 86-272 or PL. Tuesday December 21 2021. 4 2021 revised Statement of Information Concerning Practices.

In 1986 the MTC adopted the Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States Under Public Law 86-272 which sets forth.

Mtc Is Reconsidering P L 86 272 What You Need To Know

Public Law 86 272 S Thin Veil Of Income Tax Protection Is Getting Thinner 2022 Articles Resources Cla Cliftonlarsonallen

Interpretation Update To Law Protecting Businesses From Nexus Dhjj

Mtc Is Reconsidering P L 86 272 What You Need To Know

New York Takes Steps To Follow Revised Mtc P L 86 272 Guidance Bst Co Llp

Recent Multistate Tax Commission Guidance May Increase Tax Burden On Multistate Tangible Property Sellers Mlr

California S Pl 86 272 Guidance Headed To Court Taxops

Multistate Tax Commission Votes To Adopt A New Revision To Public Law Withum

Let S Talk About State Taxes And Nexus Htj Tax

E Commerce Businesses Beware The Mtc Is Coming For Your Pl 86 272 Protection Publications Insights Faegre Drinker Biddle Reath Llp

Online Business New York Is Preparing To Lose Protection On Pl 86 272

2021 Multistate Tax Developments Dbriefs Webcast Deloitte Us

Multistate Tax Commission Puts Shine On Venerable Public Law 86 272

Multistate Tax Commission Issues New Interpretation On P L 86 272 Pertaining To E Commerce Forvis

Multistate Tax Commission Issues New Interpretation For Nexus Regarding E Commerce Businesses Wilkinguttenplan

State Income Tax Nexus And Public Law 86 272 Our Insights Plante Moran

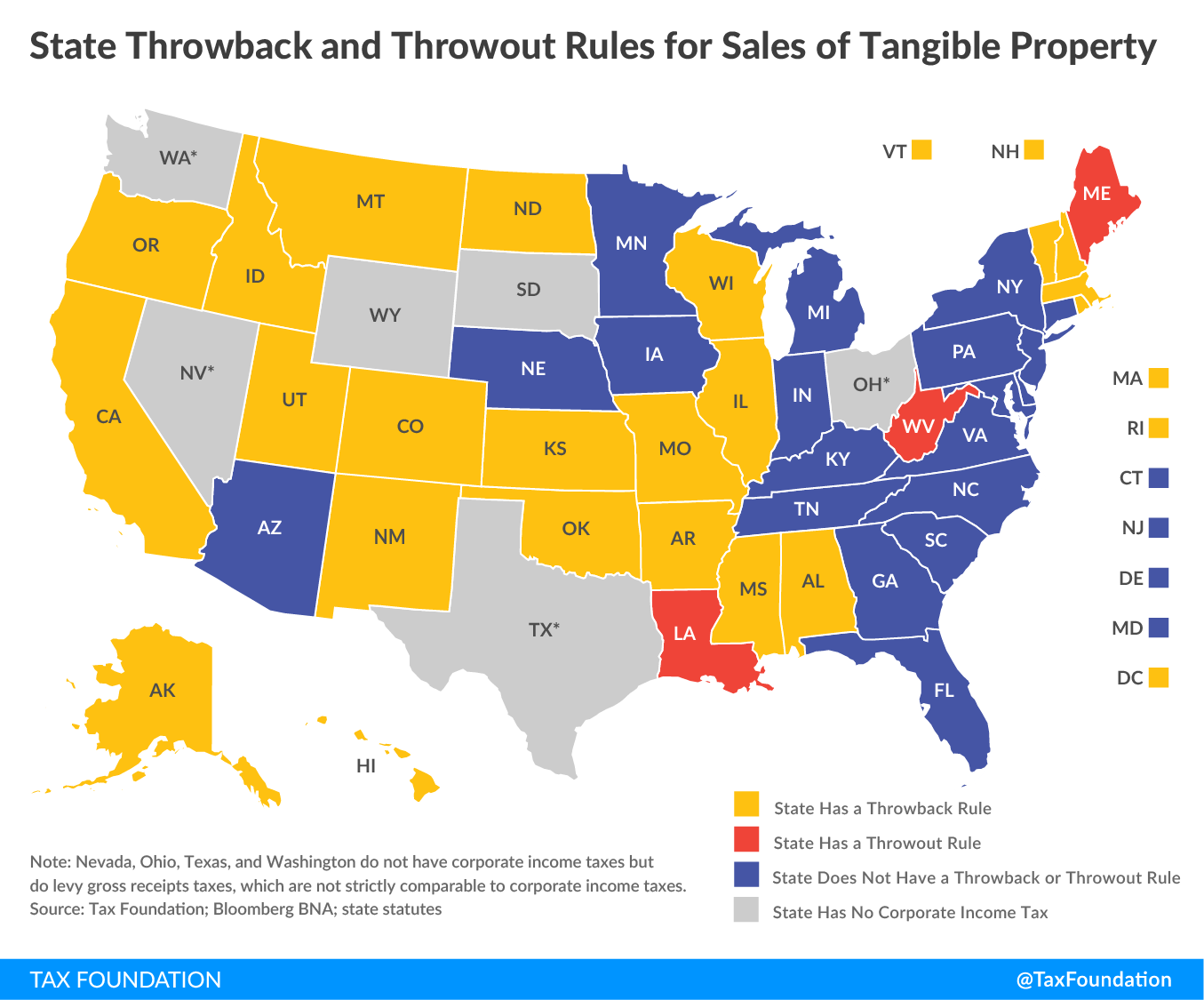

State Throwback Rules And Throwout Rules A Primer Tax Foundation

Podcast Data Processing Pl 86 272 And The Mtc Partnership Tax Project Bakerhostetler Jdsupra

Mtc Cookie Monster Seeks To Take A Huge Bite Out Of Pub L 86 272 Fredrikson Byron Fredrikson Byron P A